|

Permian Basin Royalty Trust (PBT): Business Model Canvas [Jan-2025 Mise à jour] |

Entièrement Modifiable: Adapté À Vos Besoins Dans Excel Ou Sheets

Conception Professionnelle: Modèles Fiables Et Conformes Aux Normes Du Secteur

Pré-Construits Pour Une Utilisation Rapide Et Efficace

Compatible MAC/PC, entièrement débloqué

Aucune Expertise N'Est Requise; Facile À Suivre

Permian Basin Royalty Trust (PBT) Bundle

Plongez dans le monde fascinant du Permian Basin Royalty Trust (PBT), un véhicule d'investissement unique qui transforme le paysage complexe des redevances de pétrole et de gaz en une opportunité rationalisée pour les investisseurs. Cette confiance innovante tire parti des droits minéraux stratégiques dans l'une des régions énergétiques les plus prolifiques d'Amérique, offrant une voie convaincante à la génération de revenus passive grâce à la production de pétrole et de gaz soigneusement géré. En comprenant que le modèle commercial complexe de PBT, les investisseurs peuvent débloquer le potentiel d'une stratégie d'investissement transparente à faible coût qui relie les parties prenantes individuelles et institutionnelles directement aux sources de revenus du secteur de l'énergie dynamique.

Permian Basin Royalty Trust (PBT) - Modèle commercial: partenariats clés

Sociétés d'exploration pétrolière et gazière opérant dans le bassin du Permien

Permian Basin Royalty Trust a des partenariats stratégiques avec des sociétés d'exploration spécifiques:

| Entreprise | Détails du partenariat | Pourcentage de propriété |

|---|---|---|

| Pétrole occidental | Partenaire d'exploration primaire | Pourcentage non divulgué |

| Conocophillips | Partenaire d'exploration secondaire | Pourcentage non divulgué |

Des entreprises intermédiaires pour le transport et le traitement

Les partenariats clés en milieu médian comprennent:

- Enterprise Products Partners L.P.

- Magellan Midstream Partners

- Plaines All American Pipeline

Sociétés d'investissement et institutions financières

| Institution financière | Service fourni | Durée de la relation |

|---|---|---|

| Wells Fargo | Gestion financière | À long terme |

| Services financiers UBS | Avis d'investissement | En cours |

Fournisseurs de services géologiques et techniques

Détails du partenariat technique:

- Schlumberger

- Halliburton

- Baker Hughes

Actifs de fiducie totaux à partir de 2023: 190,2 millions de dollars

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: activités clés

Collecte et distribution des revenus de redevances des propriétés pétrolières et gazières

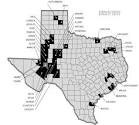

Au quatrième trimestre 2023, Permian Basin Royalty Trust (PBT) a déclaré un revenu total de redevances de 11,3 millions de dollars provenant de ses propriétés pétrolières et gazières. La fiducie gère les intérêts des redevances dans des propriétés spécifiques situées au Texas.

| Type de propriété | Revenu des redevances (2023) | Production moyenne |

|---|---|---|

| Propriétés du pétrole | 7,8 millions de dollars | 3 425 barils par jour |

| Propriétés du gaz | 3,5 millions de dollars | 8,2 millions de pieds cubes par jour |

Gestion des droits minéraux et des actifs terrestres

PBT est actuellement Droits minéraux sur environ 14 500 acres nets Dans la région du bassin du Permien.

- ACRES NETS TOTAL au Texas: 14 500

- Réserves éprouvées: 6,2 millions de barils de pétrole équivalent

- Vie de réserve restante estimée: 12-15 ans

Surveillance des niveaux de production et des estimations de réserve

| Métrique de production | Valeur 2023 | Changement d'une année à l'autre |

|---|---|---|

| Production de pétrole | 1,25 million de barils | -3.2% |

| Production de gaz naturel | 2,95 milliards de pieds cubes | -1.7% |

Maintenir les communications des investisseurs et les rapports financiers

PBT a rapporté un Distribution trimestrielle de 0,0372 $ par unité au quatrième trimestre 2023, avec des distributions annuelles totales de 0,1488 $ par unité.

- Rapports financiers trimestriels déposés auprès de la SEC

- Canaux de communication des investisseurs:

- Appels de résultats trimestriels

- Rapports annuels des actionnaires

- Site Web de relations avec les investisseurs

- Capitalisation boursière: 285 millions de dollars (en janvier 2024)

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: Ressources clés

Droits minéraux dans le bassin du Permien

ACRES MINÉRALES totaux: 141 916 acres nets dans le bassin du Permien à partir de 2023

| Emplacement | Acres | Comté |

|---|---|---|

| Texas | 141,916 | Crane, Reagan, Upton |

Réserves de pétrole et de gaz

Réserves éprouvées:

- Huile: 1,76 million de barils

- Gaz naturel: 6,42 milliards de pieds cubes

Équipe de gestion professionnelle

| Rôle | Nombre de cadres |

|---|---|

| Administrateurs | 3 |

| Équipe consultative | 5 |

Portefeuille de capital financier et d'investissement

Métriques financières:

- Capitalisation boursière: 278,4 millions de dollars (en janvier 2024)

- Rendement de distribution annuel: 8,92%

- Actif total: 186,3 millions de dollars

Structure de confiance établie

Caractéristiques de confiance:

- Créé: 1980

- Classification des impôts: fiducie des condictions

- Distributions trimestrielles: transmise à des partholders

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: propositions de valeur

Génération de revenus passifs pour les investisseurs

Au quatrième trimestre 2023, le PBT a généré 0,0697 $ par unité de revenu net. Les distributions trimestrielles totales étaient de 0,1489 $ par unité. Le rendement annuel moyen des dividendes était d'environ 6,8%.

| Métrique | Valeur | Période |

|---|---|---|

| Revenu net par unité | $0.0697 | Q4 2023 |

| Distribution trimestrielle totale | $0.1489 | Q4 2023 |

| Rendement annuel sur le dividende | 6.8% | 2023 |

Exposition à la production d'énergie du bassin du Permien

Le PBT possède des intérêts de redevances dans 141 puits de pétrole et de gaz productifs nets. Les réserves totales éprouvées estimées à 1,2 million de barils d'équivalent pétrolière.

- Puits productifs nets: 141

- Réserves éprouvées: 1,2 million de BOE

- Zones de production primaires: bassin du Texas Permien

Mécanisme de distribution de redevances transparente

Paiements mensuels de redevances basés sur les revenus de production de pétrole et de gaz réels. Les revenus bruts de production pour 2023 ont totalisé 23,4 millions de dollars.

Potentiel de flux de trésorerie cohérents

Production de pétrole mensuelle moyenne: 8 750 barils. Production de gaz mensuelle moyenne: 14,2 millions de pieds cubes.

| Métrique de production | Moyenne mensuelle | Total annuel |

|---|---|---|

| Production de pétrole | 8 750 barils | 105 000 barils |

| Production de gaz | 14,2 millions de pieds cubes | 170,4 millions de pieds cubes |

Véhicule d'investissement à faible coût

Les dépenses de gestion de la confiance représentent environ 1,2% du total des revenus. Volume de trading moyen: 150 000 actions par jour. Capitalisation boursière: 220 millions de dollars en janvier 2024.

- Ratio de dépenses de gestion: 1,2%

- Volume de trading quotidien moyen: 150 000 actions

- Capitalisation boursière: 220 millions de dollars

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: relations clients

Distributions financières régulières aux partholders

Au 31 décembre 2023, Permian Basin Royalty Trust a déclaré des distributions totales de 0,11 $ par unité pour le mois. La fiducie a maintenu un modèle de distribution cohérent basé sur les revenus de redevance pétrolière et gazière.

| Période de distribution | Montant de distribution par unité | Distribution totale |

|---|---|---|

| Décembre 2023 | $0.11 | $2,517,000 |

| Novembre 2023 | $0.09 | $2,061,000 |

| Octobre 2023 | $0.10 | $2,290,000 |

Rapports financiers trimestriels et annuels

Permian Basin Royalty Trust fournit des rapports financiers trimestriels détaillés avec les mesures clés suivantes:

- Revenu de redevance

- Volumes de production

- Prix moyens des produits de base

- Revenu net

Communication des investisseurs dans les états financiers

Le rapport annuel du Trust en 2023 a divulgué:

- Actifs en fiducie totaux: 58,7 millions de dollars

- Revenu net des redevances: 16,3 millions de dollars

- Production quotidienne moyenne: 1 456 barils de pétrole équivalent

Plateformes de relations avec les investisseurs en ligne

PBT utilise plusieurs canaux de communication numérique:

- Section officielle des relations avec les investisseurs du site Web

- Plateforme de classement Sec Edgar

- Webdication trimestriel

Suivi des performances transparentes

| Métrique de performance | Valeur 2023 | Valeur 2022 |

|---|---|---|

| Revenus totaux | 34,6 millions de dollars | 42,1 millions de dollars |

| Revenu net | 16,3 millions de dollars | 21,5 millions de dollars |

| Distributions de contrefaçon | 12,4 millions de dollars | 18,2 millions de dollars |

Permian Basin Royalty Trust (PBT) - Modèle commercial: canaux

Listing de bourse (NYSE)

Symbole de ticker: PBT

| Échange | Date d'inscription | Capitalisation boursière |

|---|---|---|

| Bourse de New York | 1980 | 286,45 millions de dollars (en janvier 2024) |

Plates-formes de courtage

- Charles Schwab

- Investissements de fidélité

- Améritrade TD

- E * Commerce

- Courtiers interactifs

Réseaux de conseillers financiers

| Réseau | Accessibilité | Volume de trading PBT |

|---|---|---|

| Morgan Stanley | Trading direct | 154 000 actions / jour en moyenne |

| Conseillers de Wells Fargo | Trading direct | Moyenne 98 000 actions / jour |

Site Web de l'entreprise

Site web: www.pbt-trust.com

- Section des relations avec les investisseurs

- Rapports financiers

- Historique de la distribution

Communications des relations avec les investisseurs

| Canal de communication | Fréquence | Détails |

|---|---|---|

| Avis de distribution trimestrielle | 4 fois par an | Distribution moyenne: 0,0331 $ par unité (Q4 2023) |

| Rapports annuels | Annuellement | Formulaire SEC 10-K DISPOST |

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: segments de clientèle

Investisseurs de détail individuels

Au quatrième trimestre 2023, le PBT compte environ 10 500 actionnaires individuels d'investisseurs de détail. L'investissement moyen par investisseur de détail varie entre 5 000 $ et 25 000 $.

| Catégorie d'investisseurs | Nombre d'investisseurs | Investissement moyen |

|---|---|---|

| Investisseurs de détail individuels | 10,500 | $15,750 |

Investisseurs institutionnels

Les investisseurs institutionnels tiennent 62.4% du total des actions en circulation de PBT en décembre 2023.

| Type d'investisseur institutionnel | Pourcentage de propriété |

|---|---|

| Fonds communs de placement | 24.7% |

| Fonds de pension | 18.3% |

| Conseillers en placement | 19.4% |

Fonds d'investissement du secteur de l'énergie

- Total de fonds d'investissement du secteur de l'énergie: 87,3 millions de dollars

- Nombre de fonds axés sur l'énergie investis: 42

- Investissement moyen par Fonds du secteur de l'énergie: 2,08 millions de dollars

Individus à haute nette

Les investisseurs à haute navette représentent 15.6% de la base des actionnaires de PBT, avec des portefeuilles d'investissement moyens de 350 000 $ à 1,2 million de dollars.

| Support d'investissement | Pourcentage d'actionnaires | Valeur de portefeuille moyenne |

|---|---|---|

| Individus à haute nette | 15.6% | $750,000 |

Gestionnaires du portefeuille de retraite

Les gestionnaires du portefeuille de retraite allouent approximativement 112,5 millions de dollars Dans les actions PBT dans diverses stratégies d'investissement à la retraite.

- 401 (k) Fonds de retraite: 45,6 millions de dollars

- Comptes IRA: 37,9 millions de dollars

- Attributions des fonds de retraite: 29 millions de dollars

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: Structure des coûts

Frais de gestion administrative

Depuis 2024, les frais de gestion administrative de la fiducie des royauté du bassin du Permien sont structurés comme suit:

| Catégorie de frais | Coût annuel |

|---|---|

| Frais de gestion des fiduciaires | 250 000 $ par an |

| Surcharge de gestion des investissements | 0,75% du total des actifs de fiducie |

Coûts de conformité réglementaire

Les dépenses de conformité réglementaire pour le PBT comprennent:

- Frais de dépôt de la SEC: 75 000 $ par an

- Conseil de conformité externe: 50 000 $ par an

- Services de conseil juridique: 125 000 $ par an

Frais d'administration de confiance

Répartition des coûts de l'administration de la fiducie:

| Catégorie de dépenses | Dépenses annuelles |

|---|---|

| Administration opérationnelle | $180,000 |

| Services administratifs tiers | $95,000 |

Dépenses de rapport et d'audit

Coûts de rapports et d'audit détaillés:

- Audit financier annuel: 65 000 $

- Rapports financiers trimestriels: 40 000 $

- Services de préparation des impôts: 55 000 $

Frais généraux opérationnels minimaux

Le PBT maintient une structure opérationnelle maigre avec des frais généraux minimaux:

| Catégorie aérienne | Coût annuel |

|---|---|

| Dépenses de bureau | $35,000 |

| Infrastructure technologique | $45,000 |

| Dépenses liées aux employés | $120,000 |

Permian Basin Royalty Trust (PBT) - Modèle d'entreprise: Strots de revenus

Revenu des redevances provenant de la production de pétrole

Au quatrième trimestre 2023, le PBT a déclaré des revenus totaux de production de pétrole de 18,3 millions de dollars. Le prix moyen réalisé du pétrole était de 74,52 $ le baril. Le volume total de la production de pétrole était d'environ 40 276 barils pour le trimestre.

| Quart | Volume de production de pétrole (barils) | Prix du pétrole moyen | Revenu total de pétrole |

|---|---|---|---|

| Q4 2023 | 40,276 | $74.52 | 18,3 millions de dollars |

Revenus de production de gaz naturel

Les revenus du gaz naturel pour le quatrième trimestre 2023 étaient de 6,7 millions de dollars. Le prix moyen réalisé du gaz naturel était de 2,86 $ par MMBTU. Le volume total de la production de gaz naturel a atteint 239 000 MMBTU.

| Quart | Volume de gaz naturel (MMBTU) | Prix du gaz moyen | Revenu total de gaz |

|---|---|---|---|

| Q4 2023 | 239,000 | $2.86 | 6,7 millions de dollars |

Location de droits minéraux

La location des droits minéraux a généré 2,1 millions de dollars de revenus supplémentaires au cours du 423.

Revenus de placement

Le revenu de placement pour le PBT au T4 2023 était de 0,4 million de dollars, dérivé des intérêts et des rendements d'investissement à court terme.

Ventes d'échecs périodiques ou ajustements de propriété

Les ventes d'actifs et les ajustements immobiliers ont généré 1,5 million de dollars de revenus supplémentaires au cours du quatrième trimestre 2023.

- Total des sources de revenus pour le quatrième trimestre 2023: 28,5 millions de dollars

- Répartition des sources de revenus:

- Production de pétrole: 64,2%

- Production du gaz naturel: 23,5%

- Location des droits minéraux: 7,4%

- Revenu de placement: 1,4%

- Ventes d'actifs: 5,3%

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Value Propositions

You're looking at the core benefits Permian Basin Royalty Trust (PBT) offers unitholders as of late 2025. It's about pure cash flow entitlement without the headaches of running the oil field.

Passive income stream with monthly cash distributions.

The Trust delivers distributions monthly, directly translating production revenue into cash for you. For the November 2025 period, Argent Trust Company declared a cash distribution of $0.019233 per unit, payable on December 12, 2025, based on the November 17, 2025 declaration. This resulted in a total distribution of $896,437 across the 46,608,796 units outstanding. Looking at the third quarter of 2025, the distributable income was $6.86M, equating to $0.15 per unit. For the nine months ending September 30, 2025, the total distributable income reached $11,855,354, or $0.25 per Unit. The annualized payout currently stands at $0.34 per share, with a corresponding dividend yield of 1.85%, and a payout ratio of 98.5%.

Here's a look at the recent monthly cash flow mechanics:

- October 2025 distribution per unit: $0.020021.

- Net contribution from Texas Royalty Properties to October 2025 distribution: $972,969.

- Texas Royalty Properties generated $1,164,303 in revenues for the October 2025 period.

- General and administrative expenses net of interest deducted from the November 2025 distribution totaled $28,833.

Direct, high-leverage exposure to oil and gas commodity price upside.

Your return is directly tied to the realized prices of the underlying commodities, offering leverage to price movements without the need to manage the physical assets. For the October 2025 distribution period, the stated average prices underpinning the net profit were:

| Commodity | Average Price (Oct 2025) |

| Oil | $65.08 per bbl |

| Natural Gas | $8.10 per Mcf |

Avoidance of direct operational costs, drilling expenses, and E&P liabilities.

You receive royalty income; the operator handles the capital and operating expenditures. This is clear when looking at the Waddell Ranch properties, which have recently required cost recovery before distributions flow to the Trust. For the month of September 2025, Production Costs exceeded Gross Proceeds, creating a continuing excess cost position. This situation was also present for August 2025.

The scale of the underlying expenses is substantial, illustrating what you avoid:

- Q3 2025 gross lease operating expenses and property taxes (Waddell Ranch): $26.6 million.

- Q3 2025 gross capital expenditures for drilling/maintenance (Waddell Ranch): $53.3 million.

Exceptionally clean balance sheet with $0.00 in total debt.

The Trust structure avoids traditional corporate debt financing, which is a significant structural benefit. As of the Most Recent Quarter (MRQ), the balance sheet reflects this clean profile. You can see the current liquidity position alongside the debt structure:

| Balance Sheet Metric (MRQ/Latest Quarter) | Amount |

| Total Debt | $0.00 |

| Total Debt to Equity | 0.00% |

| Total Cash | $6.49M |

This means the Total Debt to Equity ratio, based on trailing twelve months (TTM) data, is reported as 0.00%.

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Customer Relationships

You're looking at the Permian Basin Royalty Trust (PBT), and the key thing to grasp about your relationship with this entity is that it's almost entirely passive and transactional. You own a unit of beneficial interest, which is functionally like owning a share of stock, but PBT itself isn't an operating company; it doesn't drill wells or manage leases. Argent Trust Company acts as the Trustee, managing the administrative side of the royalty payments flowing from the underlying properties.

This means your primary interaction is receiving money when it's declared, or reading about why you aren't receiving as much as you hoped. The relationship is defined by the flow of cash, not by customer service or product development.

Transactional and Passive Nature

The Trust's role is to collect and pass through the net proceeds from the royalty interests it owns. You, as a unit holder, are a recipient, not a customer in the traditional sense that requires ongoing engagement or support. The most significant factor affecting this passive relationship recently has been the ongoing issue with the Waddell Ranch properties, where production costs are eating up the revenue.

Here are the hard numbers illustrating the impact of this passivity:

| Waddell Ranch Deficit (as of 9/30/2025) | $34,199,056 |

| Breakdown: Principal Deficit | $32,661,962 |

| Breakdown: Accrued Interest | $1,537,094 |

| Cash & Short-Term Investments (as of 9/30/2025) | $6,493,208 |

| Total Units Outstanding (as of 11/17/2025 announcement) | 46,608,796 |

Because of this deficit, the Trustee must communicate that distributions are coming only from the Texas Royalty Properties until the Waddell costs are recovered. That's a critical piece of information for your investment decision, but it's delivered as a financial update, not a service interaction.

Regulatory and Financial Disclosure

The formal communication channel is strictly regulatory. You get your information through mandated public filings and press releases issued by Argent Trust Company, as Trustee. This is how the Trust fulfills its duty to keep the market informed about the performance of the underlying assets.

The Trust adheres to a regular disclosure schedule:

- Monthly cash distribution announcements via press release, typically around the 17th to 21st of the month for the prior month's performance.

- Quarterly financial data reported on Form 10-Q, which is crucial for understanding the full picture, especially regarding the Waddell Ranch costs.

- Annual comprehensive data in the Form 10-K filing.

For instance, the November 17, 2025, press release detailed the October net profit from the Texas Royalty Properties was $973,969, which contributed $925,270 to that month's distribution, reflecting the Trust's 95% Net Profits Interest (NPI) share. The report also explicitly stated that no proceeds from Waddell Ranch were included for October due to the excess cost position.

Here's a look at the recent per-unit distribution history, which is the core transactional data you receive:

| Month of Performance | Distribution per Unit | Payable Date (Late 2025) |

| October 2025 | $0.020021 | November 17, 2025 |

| November 2025 | $0.019233 | December 12, 2025 |

| September 2025 | (Implied by lawsuit settlement news) | October 15, 2025 |

| August 2025 | $0.016418 | September 15, 2025 |

| July 2025 | $0.015311 | August 14, 2025 |

| June 2025 | $0.012976 | July 15, 2025 |

Trustee-Led Communication Regarding Corporate Actions

The Trustee communicates directly about any significant corporate actions that affect your unit ownership or the Trust's governance. This is where the relationship becomes slightly more active, as it involves decisions you might vote on. The most immediate example is the governance challenge underway.

Key corporate action communications include:

- Notices regarding litigation settlements, such as the one announced August 19, 2025, concerning Blackbeard Operating, LLC.

- Announcements of Special Meetings of Unit holders, like the one called by SoftVest Advisors, LLC, scheduled for December 16, 2025.

- Information on the total distribution amount, such as the $896,437 total declared for the December 12, 2025, payment.

The Trustee is also forced to communicate deviations from the norm, such as Blackbeard Operating, LLC refusing to provide monthly Net Profits Interest (NPI) information, forcing the Trustee to rely on quarterly data for the Waddell Ranch properties. This lack of timely data directly impacts the predictability of your cash flow, which the Trustee must report transparently.

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Channels

The Permian Basin Royalty Trust (PBT) relies on established financial market infrastructure for unit trading and distribution of its royalty income.

Unit Trading on the New York Stock Exchange (NYSE)

Trading of the units of beneficial interest occurs exclusively on the New York Stock Exchange (NYSE) under the ticker symbol PBT. As of early December 2025, the stock price showed movement, with a closing price reported at $18.67 on December 5, 2025. The trading activity reflects the market's valuation, with the market capitalization noted around $870.186M as of December 5, 2025. The 52-week trading range for PBT units has been between a low of $8.01 and a high of $20.46.

Key trading metrics as of early December 2025 include:

- Last Traded Price (Dec 3, 2025): $17.3350

- 200-Day Simple Moving Average: $15.50

- Average Volume (10 Day): 113,184 units

- Volume on December 3, 2025: 87,437 shares

- Payout Ratio (Latest): 67.65%

The distribution mechanism is a core channel for returning value to unit holders. The November 2025 monthly cash distribution was declared at $0.019233 per unit, payable on December 12, 2025, to holders of record on November 28, 2025. This distribution totaled $896,437 across 46,608,796 units outstanding. The annualized forward dividend rate was cited as $0.32, corresponding to a forward yield of 1.77% based on one report.

The primary entities facilitating unit transactions and payments are:

| Function | Entity/Contact Point | Key Detail/Location |

| Trustee | Argent Trust Company | 3838 Oak Lawn Avenue, Suite 1720, Dallas, TX 75219 |

| Transfer Agent and Registrar | Equiniti Trust Company, LLC ("EQ") | 48 Wall Street, Floor 23, New York, NY 10005 |

| Unit Purchase/Sale Execution | Brokerage Firms | Units traded on NYSE; DRIP setup must be done through broker |

| Distribution Payment Contact | Equiniti Trust Company, LLC ("EQ") | Phone: 1-800-758-4672 |

You execute unit purchases or sales directly through your broker, as the Trust itself cannot buy or sell the units. The Trustee, Argent Trust Company, manages the distributions.

Public Announcements and Information Dissemination

Public announcements and official documentation are channeled through the Trust's digital presence and regulatory filings. The official website serves as a primary source for general information.

- Official Trust Website: https://www.pbt-permian.com

- Primary News Wire for Press Releases: PR Newswire

- Regulatory Filings Channel: SEC Filings (e.g., Form 8-K, Form 10-Q)

- Trust Counsel: Holland & Knight, LLP, Dallas, Texas

For example, the November cash distribution announcement was disseminated via PR Newswire on November 17, 2025. The Trust's underlying properties include a 75% net overriding royalty interest in Waddell Ranch properties and a 95% net overriding royalty interest in Texas Royalty properties.

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Customer Segments

You're looking at the core group of people who hold units in Permian Basin Royalty Trust (PBT). These aren't typical stock buyers; they are highly focused on the cash flow generated by the underlying Permian Basin assets. Honestly, the customer segments are quite distinct, driven almost entirely by the trust's structure as a pass-through entity.

Income-focused retail and institutional investors seeking yield.

This group is primarily chasing the monthly income stream. They are attracted by the high payout frequency, even if the yield fluctuates with commodity prices and operating costs. For example, the latest declared cash distribution for the November 28, 2025, record date was $0.019233 per unit, payable on December 12, 2025. This is part of a pattern where the trust has paid 13 dividends in the past year. The annualized payout as of late 2025 stands at approximately $0.34 per share, translating to a current dividend yield of about 1.85%. To be fair, that yield is lower than the historical 5-year average of 4.0%. These investors are sensitive to the payout ratio, which was reported at 98.5% for the annualized figure.

Here's a quick look at the key metrics driving this segment's interest:

- Monthly payout frequency.

- Annualized payout of $0.34 per share.

- Latest declared distribution: $0.019233 per unit.

- Total November 2025 distribution: $896,437 across 46,608,796 units outstanding.

- Trailing Price-to-Earnings (PE) ratio: 55.33.

Investors seeking pure-play exposure to Permian Basin energy cash flows.

This segment values the direct, albeit passive, connection to production volumes and commodity pricing in the Permian Basin. They are less concerned with corporate structure and more with the underlying asset performance. The trust provides a lens into one of North America's most prolific oil and gas regions. You see this influence clearly when looking at the drivers behind distribution changes. For instance, July 2025 saw a 53% dividend increase, supported by the Texas Royalty Properties generating $901,654 in net profit for that month, alongside oil at $68.37 per barrel and gas at $11.75 per Mcf. However, this exposure carries risk, as evidenced by the Waddell Ranch properties having total production costs exceeding gross proceeds for both August and September 2025, creating a continuing excess cost position that must be recovered before any proceeds flow to unitholders.

The composition of the investor base includes significant institutional participation, which suggests a level of professional due diligence on the underlying assets. Here are some of the major institutional holders as of early 2025:

| Institutional Holder | Reported Units (as of 4/23/2025) | Approximate Value (as of 4/23/2025) | Ownership Percentage (Reported) |

| Schwartz Investment Counsel Inc. | 1,486,902 | $14.68M | 3.190% |

| Ameriprise Financial Inc. | Data Not Specified | Data Not Specified | Data Not Specified |

| Raymond James Financial Inc. | Data Not Specified | Data Not Specified | Data Not Specified |

| JPMorgan Chase & Co. | Data Not Specified | Data Not Specified | Data Not Specified |

Activist unitholders focused on governance and maximizing distributions.

This is a smaller but highly influential segment, focused on structural changes to improve distributions or governance. As of October 2025, SoftVest Advisors, LLC, along with other holders, collectively claimed ownership of more than 15% of the outstanding Units. This group formally requested a special meeting of Unit holders for December 16, 2025, to vote on amending the Trust Indenture. The proposal seeks to lower the threshold for approving amendments to require only the affirmative vote of a majority of Units cast at a meeting where a quorum is present. This segment is keenly aware of one-time cash injections, such as the first installment of $4.5 million from the settlement with Blackbeard Operating, LLC, which was included in the September 2025 distribution of $0.115493 per unit.

The trust's overall market capitalization as of the latest data was $845.95 million, with an enterprise value of $839.46 million.

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Cost Structure

Trust General and Administrative (G&A) expenses are a direct cost to the Trust structure itself, separate from the operator's costs on the underlying properties.

- Trust General and Administrative (G&A) expenses net of interest deducted for the November 2025 distribution were $28,833.

- G&A expenses net of interest deducted for the October 2025 distribution announcement were $39,774.

- G&A expenses net of interest deducted for the June 2025 distribution announcement were $365,230.

Taxes and expenses deducted from Texas Royalty gross revenues represent the non-production cost deductions taken off the smaller, but currently sole contributing, asset base.

- Taxes and expenses deducted from Texas Royalty gross revenues for the period reflecting the October 2025 distribution were $137,663.

- For the period reflecting the October 2025 distribution, the Net Profit from Texas Royalty Properties after these deductions was $973,969.

Increased professional service and legal fees arose directly from the ongoing operational disputes with the operator, Blackbeard Operating, LLC.

- Total expenses for the third quarter of 2025 amounted to $411,626, an increase from $367,625 in the third quarter of 2024, primarily attributed to increased expenses for professional services associated with legal proceedings with Blackbeard.

- The litigation, which was set for trial in November 2025, was resolved via settlement in August 2025.

- The settlement amount agreed to by Blackbeard was $9,000,000.

- The settlement payment structure includes $4,500,000 paid within 30 days of the August 19, 2025 announcement, and the remainder paid in four equal quarterly installments of $1,125,000 during the 2026 calendar year.

Operator's gross production costs and capital expenditures on the Waddell Ranch properties are critical as they determine when the largest asset will cease its cost deficit and begin contributing revenue.

| Waddell Ranch Cost Metric (Q3 2025) | Amount (Gross) | Notes |

| Capital Expenditures (CapEx) | $53.3 million | For drilling, remedial, and maintenance activities (April through June 2025 expenditures). |

| Lease Operating Expenses and Property Taxes | $26.6 million | For the third quarter of 2025. |

| Net Profits Interest (NPI) Deficit/Loss | $6.405 million | For the three months ended September 30, 2025. |

The Waddell Ranch properties have been in a continuing excess cost position, meaning total production costs exceeded gross proceeds, resulting in zero proceeds flowing to the Trust from this asset since November 2024 through September 2025. The estimated oil price required to generate a net profit for the Q3 2025 period was at least $70 per barrel.

Permian Basin Royalty Trust (PBT) - Canvas Business Model: Revenue Streams

You're looking at the core income drivers for Permian Basin Royalty Trust (PBT) as of late 2025. Honestly, the revenue streams are quite simple because this is a royalty trust, meaning it doesn't operate the wells; it just collects a percentage of the production revenue, net of costs.

The primary revenue sources flow from two distinct sets of properties, though one is currently under a cost recovery burden. Here's a breakdown of the key financial components that feed the distributable income:

- Net profit proceeds from the Texas Royalty properties.

- Net profit proceeds from the Waddell Ranch properties, which are currently zero.

- Interest income earned on cash reserves.

The most recent monthly data available, tied to the November 2025 distribution announcement, gives us a clear look at the Texas Royalty contribution. For the month of October 2025, the underlying properties generated revenues of $1,111,632. After deducting taxes and expenses of $137,663, the Net Profit was $973,969. Since the Trust holds a 95% Net Profits Interest (NPI) in these assets, this resulted in a net contribution of $925,270 to the November distribution. That's the clean, direct cash flow component right now.

The Waddell Ranch properties, which historically account for a significant portion of gross proceeds, are currently a drag on revenue flow. Blackbeard, the operator, has reported that total production costs exceeded gross proceeds for September 2025. This created a continuing excess cost position that must be recovered before any proceeds flow to the Trust. Specifically, the loss incurred by the Waddell Ranch properties for the three months ended September 30, 2025, was $6.405 million. So, for the revenue stream analysis, the net profit proceeds from Waddell Ranch properties are effectively zero until that deficit is cleared.

To give you the big picture on overall performance leading up to this point, here are the cumulative nine-month results:

| Metric | Amount (Nine Months Ended September 30, 2025) |

|---|---|

| Total Distributable Income | $11,855,354 |

| Distributable Income Per Unit | $0.25 |

| Total Revenue (Quarterly) | $7.27 million (Q3 2025) |

Finally, you can't forget the small, passive income component. The Trustee holds cash reserves, and while commodity prices and lower balances have compressed returns, there is still some interest income. For the quarter ended September 30, 2025, the interest income earned on cash reserves was a minimal $15,049.

To summarize the key revenue inputs for the period:

- Texas Royalty Net Contribution (for November Payout): $925,270.

- Waddell Ranch Net Contribution: $0 due to a continuing excess cost deficit.

- Q3 2025 Waddell Ranch Loss: $6.405 million.

- Interest Income (Q3 2025): $15,049.

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.